Featured

Table of Contents

Premiums are usually lower than whole life policies. With a degree term policy, you can pick your protection amount and the policy length. You're not secured right into an agreement for the rest of your life. Throughout your plan, you never ever need to fret about the costs or survivor benefit amounts altering.

And you can not cash out your policy during its term, so you will not get any kind of financial take advantage of your past coverage. Similar to other kinds of life insurance, the expense of a degree term plan depends on your age, insurance coverage demands, employment, lifestyle and health and wellness. Normally, you'll locate more cost effective insurance coverage if you're more youthful, healthier and less dangerous to guarantee.

Considering that degree term premiums remain the very same for the period of coverage, you'll know exactly just how much you'll pay each time. Degree term coverage additionally has some versatility, permitting you to customize your policy with additional features.

You may have to fulfill details problems and credentials for your insurance provider to enact this motorcyclist. There additionally could be an age or time restriction on the protection.

Who provides the best Best Value Level Term Life Insurance?

The survivor benefit is commonly smaller sized, and protection typically lasts until your youngster turns 18 or 25. This biker may be an extra economical means to help ensure your kids are covered as riders can commonly cover multiple dependents simultaneously. As soon as your youngster ages out of this coverage, it might be possible to convert the motorcyclist right into a new policy.

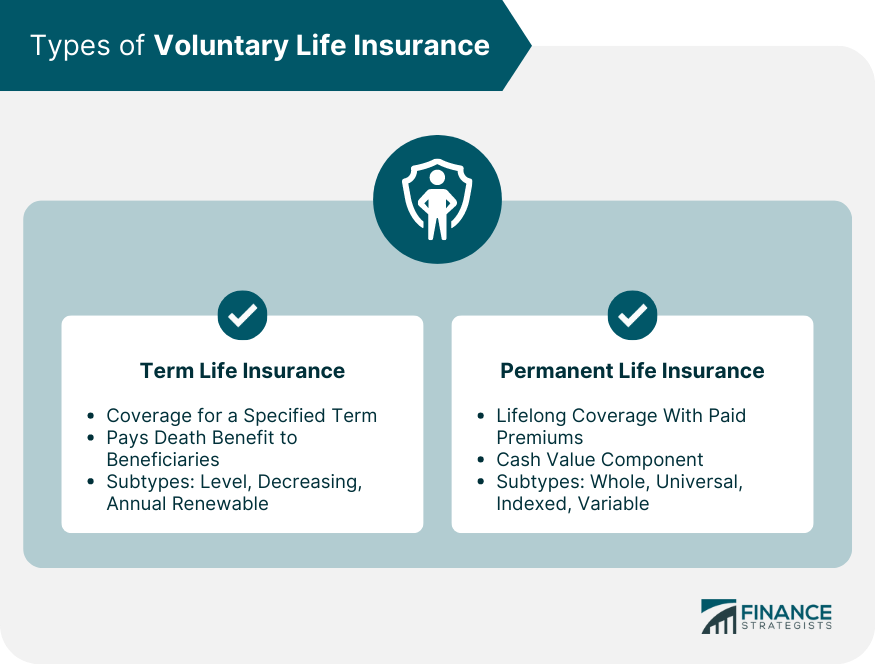

The most common kind of long-term life insurance is entire life insurance coverage, but it has some crucial distinctions compared to level term insurance coverage. Below's a fundamental summary of what to consider when contrasting term vs.

Whole life insurance lasts for life, while term coverage lasts insurance coverage a specific periodCertain The premiums for term life insurance policy are typically reduced than entire life coverage.

What happens if I don’t have Level Term Life Insurance Quotes?

One of the primary features of degree term protection is that your premiums and your fatality benefit do not transform. You may have protection that starts with a death advantage of $10,000, which can cover a home mortgage, and then each year, the fatality benefit will certainly decrease by a collection amount or percent.

Due to this, it's frequently a much more economical type of level term insurance coverage., but it might not be adequate life insurance coverage for your demands.

After selecting a plan, complete the application. For the underwriting procedure, you might have to give basic individual, health and wellness, lifestyle and work info. Your insurance firm will establish if you are insurable and the risk you might present to them, which is reflected in your premium costs. If you're accepted, sign the paperwork and pay your first costs.

You might want to update your recipient details if you have actually had any type of substantial life adjustments, such as a marital relationship, birth or divorce. Life insurance coverage can often really feel challenging.

What should I know before getting Level Term Life Insurance For Families?

No, level term life insurance policy does not have cash worth. Some life insurance policy plans have a financial investment function that enables you to build cash money value in time. Level death benefit term life insurance. A section of your costs settlements is reserved and can gain passion over time, which expands tax-deferred during the life of your protection

However, these plans are frequently considerably a lot more costly than term protection. If you reach completion of your plan and are still to life, the coverage finishes. You have some options if you still want some life insurance coverage. You can: If you're 65 and your coverage has actually gone out, for instance, you may intend to buy a brand-new 10-year level term life insurance policy policy.

How can I secure Term Life Insurance With Fixed Premiums quickly?

You may be able to transform your term protection right into an entire life plan that will last for the remainder of your life. Numerous sorts of level term plans are exchangeable. That suggests, at the end of your insurance coverage, you can convert some or all of your policy to entire life protection.

Degree term life insurance policy is a policy that lasts a set term typically between 10 and 30 years and comes with a degree survivor benefit and level costs that remain the same for the entire time the policy is in impact. This indicates you'll know exactly just how much your repayments are and when you'll need to make them, permitting you to spending plan accordingly.

Degree term can be a wonderful choice if you're wanting to get life insurance protection for the initial time. According to LIMRA's 2023 Insurance coverage Measure Study, 30% of all grownups in the United state need life insurance policy and do not have any kind of type of policy. Degree term life is predictable and cost effective, which makes it one of one of the most prominent kinds of life insurance policy

A 30-year-old man with a comparable account can anticipate to pay $29 monthly for the very same coverage. AgeGender$250,000 coverage quantity$500,000 insurance coverage quantity$1 million coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Methodology: Ordinary month-to-month rates are calculated for male and women non-smokers in a Preferred health and wellness classification getting a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy.

What is the difference between Best Level Term Life Insurance and other options?

Prices might differ by insurance company, term, coverage quantity, health class, and state. Not all policies are readily available in all states. Rate illustration valid as of 09/01/2024. It's the most inexpensive form of life insurance policy for lots of people. Level term life is a lot more economical than an equivalent whole life insurance plan. It's easy to take care of.

It permits you to budget and plan for the future. You can easily factor your life insurance policy right into your budget plan because the costs never ever change. You can prepare for the future equally as conveniently due to the fact that you recognize specifically just how much money your enjoyed ones will certainly get in case of your lack.

Level Term Life Insurance

In these instances, you'll generally have to go with a brand-new application process to obtain a much better price. If you still need coverage by the time your degree term life plan nears the expiry date, you have a couple of alternatives.

Latest Posts

Funeral Protection Insurance

Metlife Burial Insurance

Final Expense Protection