Featured

Table of Contents

Mortgage insurance pays off your mortgage to the financial institution, while life insurance policy provides a death benefit to your chosen recipient for numerous expenses. What makes a house a home? Some would claim that a house is not a home till it is full of family and various other liked ones. All life insurance policy plans are designed to assist fill up financial voids that would certainly open if the primary carrier passed away all of a sudden.

This would allow your household to continue living in the home you produced together. While all life insurance policy plans pay a fatality advantage to the recipient money that might be made use of to pay the home loan there are many other variables to take into consideration when it pertains to picking the ideal policy for your requirements.

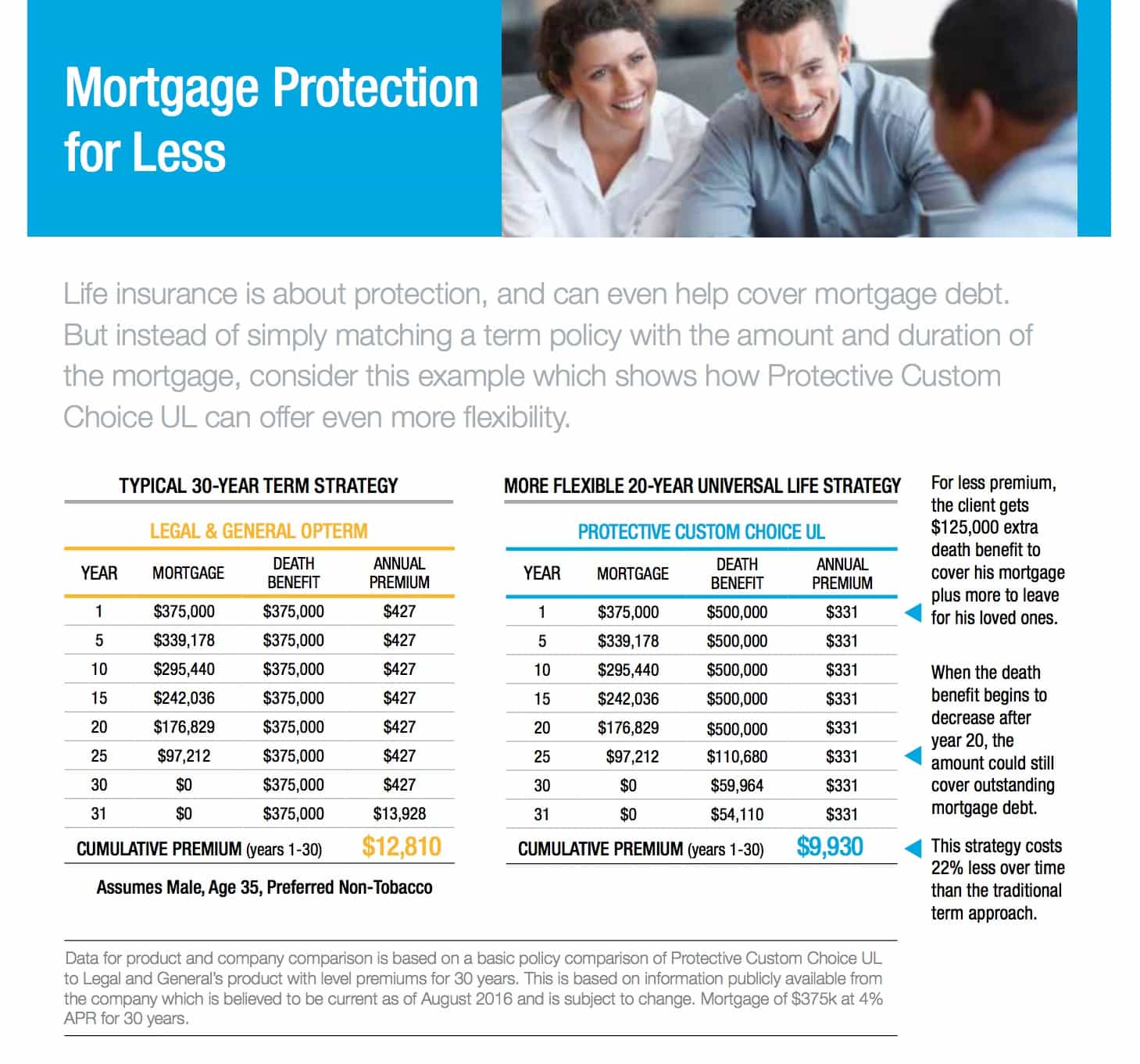

Depending on when you buy a term life plan, it could supply defense for the duration in your life when you have the most house expenditures for your household. Many individuals select term life insurance coverage to coincide with the size of their home mortgage reward.

Consider speaking to an economic representative who could assist you run the numbers and decide on the appropriate coverage quantity for your requirements. While whole life and global life insurance policy can be utilized to assist pay home loan costs, many people pick term life insurance policy instead due to the fact that it is commonly the most budget-friendly option.

Video Records Hi! Bill Diehl below at Western & Southern Financial Team and today we're mosting likely to discuss a concept called home loan needs and exactly how a life insurance policy plan may contribute with your mortgage. You heard that right: life insurance policy and mortgages. What's the bargain? Why would certainly anybody put life insurance policy and a mortgage right into the same sentence? Well, life insurance can really contribute in your mortgage approach.

But what regarding you just how are your loved ones protected? Right here's where life insurance policy is available in: if a breadwinner were to die a life insurance plan might potentially assist loved ones stay in the family members home. mortgage insurance job loss protection canada. Life insurance policy pays an instant survivor benefit as soon as evidence of death of the insured person is furnished to the insurance provider

Mortgage Protection Definition

And while these proceeds can be utilized for anything in the instance of a mortgage defense technique, they're utilized to assist keep repaying the mortgage hence allowing the making it through household to stay in their home. That's the bargain: life insurance coverage and mortgages can coexist and if you're interested in discovering even more regarding how life insurance might play a duty in your mortgage technique, talk to a monetary professional.

Hey, many thanks for viewing today! If you such as this video clip, please make sure to touch such switch below and register for this channel. Home loan insurance is a type of insurance that shields lending institutions in case a debtor defaults on their home mortgage payments. The car loan is created to decrease the danger to the lender by giving settlement for any type of losses if the consumer is unable to pay off.

Regular monthly mortgage settlements are increased to consist of the price of PMI.: MIP is a sort of insurance policy required for some lendings guaranteed by the government, like FHA (Federal Housing Management) car loans. house insurance in case of death. It protects the lending institution versus losses in case the debtor defaults on the financing. MIP might be paid upfront at the time of funding closing as an one-time fee or as part of the consumer's repeating month-to-month home mortgage repayments

It does not secure the debtor in case of default yet enables debtors to acquire a home mortgage with a reduced deposit. Also if you have mortgage insurance coverage via your bank or mortgage, you can still need life insurance. That's since bank mortgage defense just supplies home loan benefit, and the beneficiary of that plan is generally the financial institution that would certainly receive the funds.

Mortgage Redemption Insurance Calculator

It might help pay prompt expenses and provide home loan security. It might additionally assist your enjoyed ones repay financial debts, cover education costs and even more. You may even be able to change the bank mortgage insurance policy with one purchased from a life insurance business, which would allow you choose your beneficiary.

If a customer were to pass away or lose the capacity to hold back constant work for example, as a result of an injury or clinical concern MPI could cover the principal and rate of interest on the home car loan. As a home owner with a home loan, you need to prepare for the future. Let's take a hard check out what home loan security insurance needs to supply so you can determine if it makes feeling to safeguard coverage for yourself and your family.

Home mortgage protection insurance policy is a completely different kind of insurance.

When you get MPI, your plan can cover the length of your home lending. MPI is sometimes also referred to as home loan life insurance coverage or also home mortgage fatality insurance due to the fact that it pays a benefit when the policyholder dies, simply like typical life insurance policy.

There may be exclusions that stop recipients from obtaining a payment if the insurance holder were to pass away by self-destruction (in the first two years) instead than natural causes or mishap. What happens if there are numerous debtors on a home financing, though? In a lot of cases, you can acquire mortgage protection to cover 2 potentially a lot more co-borrowers or cosigners on a mortgage.

As we noted, home mortgage repayment protection insurance can include unique cyclists recognized as that cover persistent or important illness. They might likewise supply coverage for severe injuries that protect against policyholders from functioning at full capability. In these instances, customers are still active, yet because of diminished profits, are unable to make monthly home loan payments in complete.

Mppi Policy

Mortgage protection insurance coverage can cover practically any type of housing expense you want. Repay your whole home mortgage in one go? You can do that. Take down simply the minimum month-to-month settlement on your home mortgage? Absolutely. Make extra settlements on your mortgage to construct equity and pay back your finance faster? That's an alternative, too.

When those funds hit your financial institution account, you can utilize them any means you like. Invest that money on your monthly real estate prices, wait for a rainy day or cover other costs like medical expenses, car settlements and tuition. Where MPI can genuinely establish itself aside from term life insurance policy is with.

As an insurance policy holder, if you choose to increase your mortgage security insurance payment, you can do so in simply about any type of quantity you like. Take 20% currently and keep the remainder as your fatality advantage. The choice is completely your own to make. Purchase an MPI policy with living benefit bikers for crucial and chronic disease.

Do I Need Life Insurance If I Have No Mortgage

Given just how beneficial they can be for families handling difficulty, however, it might deserve seeking an insurance professional that focuses on these types of policies. In the vast bulk of instances, MPI advantages are paid out to the insurance policy holder's recipients. They can after that spend that cash any way they such as.

That is, unless you take out a credit life insurance coverage policy. These insurance coverage plans give the death advantage directly to your lender, who would certainly after that pay off your home mortgage.

It's complimentary, basic and safe. Whether home loan life insurance policy is the best plan for you depends mostly on your age and health and wellness. Young homeowners with minimal clinical issues will certainly obtain far better quotes and higher protection choices with term life insurance policy. On the other hand, if you have serious health and wellness issues and won't receive term life insurance policy, then home loan life insurance policy can be an excellent alternative, because it doesn't take your health and wellness right into account when establishing rates and will certainly provide larger fatality advantages than several options.

Some plans connect the survivor benefit to the superior home mortgage principal. This will certainly behave similarly to a lowering survivor benefit, however if you pay off your home loan faster or slower than expected, the policy will reflect that. The survivor benefit will stay the exact same over the life of the plan.

Depending on the carrier, home loan life insurance policy. A home mortgage defense policy that's packed into your home mortgage is even much more limiting, as you can not choose to terminate your insurance coverage if it comes to be unnecessary.

Mortgage Insurance Lenders

You would have to proceed paying for an unnecessary benefit. Term and home loan life insurance coverage policies have a number of resemblances, but specifically if you're healthy and balanced and a nonsmoker.

If there are much more important expenditures at the time of your death or your family members makes a decision not to keep the home, they can utilize the full term-life insurance payout nonetheless they choose. Home mortgage life insurance policy quotes are a lot more pricey for healthy and balanced property owners, due to the fact that many plans don't require you to get a medical examination.

Table of Contents

Latest Posts

Funeral Protection Insurance

Metlife Burial Insurance

Final Expense Protection

More

Latest Posts

Funeral Protection Insurance

Metlife Burial Insurance

Final Expense Protection